The role of capital income in the Hungarian income distribution

from 2007 to 2021

By Judit Krekó and Csaba G. Tóth

A new study by Judit Krekó and Csaba G. Tóth sheds light on an often-overlooked contributor to income inequality — capital income.

The study offers a detailed analysis of how capital income has influenced Hungary’s income distribution between 2007 and 2021, drawing on administrative personal income tax data. Capital income refers to earnings from investments and businesses, with dividends making up the largest share in Hungary, followed by rental income and capital gains.

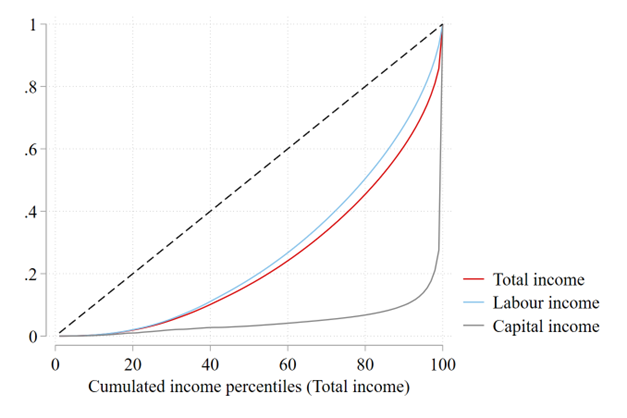

While this type of income accounted for 8–12% of total taxable income, it is highly concentrated among a small portion of the population. Only 5 to 7 percent of taxpayers received any capital income during this period, yet by 2021, the top 1 percent of earners captured 74 percent of all capital income. This high level of concentration contrasts sharply with labour income, which is distributed more evenly. While the top decile of earners captured about one-third of labour income, they controlled over 90 percent of capital income, significantly contributing to overall income inequality. By decomposing changes in inequality using the Gini index, we show that while labour income concentration was the primary driver of rising inequality, capital income also played an important role.

Using anonymized tax data from the National Tax and Customs Administration, the study highlights the advantages of administrative data over household surveys in capturing top incomes more accurately. The study demonstrates that the impact of capital income on overall inequality cannot be ignored. While capital income represents a relatively small portion of total income, its high concentration and correlation with overall income significantly amplify inequality. Older, higher-earning individuals, particularly men and Budapest residents, are more likely to receive capital income.

Between 2007 and 2021, income inequality increased significantly, particularly from 2007 to 2015, driven largely by labour income concentration following the introduction of Hungary’s flat tax system in 2011. After 2015, inequality rose further but at a slower pace, mainly due to an increasing share of capital income. A decomposition of the Gini index shows that capital income’s role in inequality strengthened over time. The research simulations suggest that if capital income’s share continues to grow, the Gini index will rise even further, indicating a widening gap between the richest and the rest of society.

The findings align with global trends, where capital income is highly concentrated among the wealthiest, exacerbating disparities. The study underscores the growing importance of capital income in driving inequality and its potential implications for economic policy and social mobility.

Krekó, J. – Tóth, C. G. (2024): The role of capital income in the Hungarian income distribution from 2007 to 2021. Intersections. East European Journal of Society and Politics, 10(3), 199–220. https://doi.org/10.17356/ieejsp.v10i3.1295.